The shares of Bharti Infratel would go live for trades from today, December 28, 2012. The Issue Price under the IPO was fixed at Rs.220/- a piece whereas the shares offered under the IPO were under a price band of Rs.210/- to Rs.240/- a share

Bharti Infratel Limited is a provider of tower and related infrastructure. Bharti Infratel is one of the world's largest telecom tower infrastructure providers which deploys, owns and manages telecom towers and communication structures for all wireless operators. The business of Bharti Infratel and Indus is to acquire, build, own and operate tower and related infrastructure.

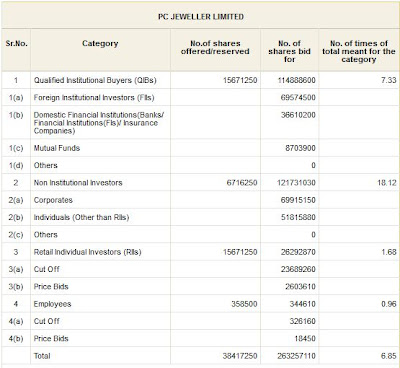

CRISIL had assigned a IPO Grade 4/5 to the IPO of Bharti Infratel. This grade indicates that the fundamentals of the Bharti Infratel IPO are 'above average' relative to the other listed equity securities in India. CRISIL assigns IPO grading on a scale of 5 to 1, with Grade 5 indicating strong fundamentals and Grade 1 indicating poor fundamentals. However, the IPO had received a weak subscription of 1.30 times on an overall basis chiefly on support from QIB investors. Click here to view PC Jeweller IPO Final Subscription Status

While the share had a grey market discount and also the lack of interest in the issue pushes for a likely listing below issue price, it remains to be seen how much resistance the share throws up to maintain a respectable level closing on the listing day

Bharti Infratel Limited is a provider of tower and related infrastructure. Bharti Infratel is one of the world's largest telecom tower infrastructure providers which deploys, owns and manages telecom towers and communication structures for all wireless operators. The business of Bharti Infratel and Indus is to acquire, build, own and operate tower and related infrastructure.

CRISIL had assigned a IPO Grade 4/5 to the IPO of Bharti Infratel. This grade indicates that the fundamentals of the Bharti Infratel IPO are 'above average' relative to the other listed equity securities in India. CRISIL assigns IPO grading on a scale of 5 to 1, with Grade 5 indicating strong fundamentals and Grade 1 indicating poor fundamentals. However, the IPO had received a weak subscription of 1.30 times on an overall basis chiefly on support from QIB investors. Click here to view PC Jeweller IPO Final Subscription Status

While the share had a grey market discount and also the lack of interest in the issue pushes for a likely listing below issue price, it remains to be seen how much resistance the share throws up to maintain a respectable level closing on the listing day