IPO opens on: Feb 28, 2017

IPO closes on: Mar 3, 2017

Issue Type: Fixed Price Issue IPO

Issue Size: 1,536,000 Equity Shares

Face Value: Rs 10 Per Equity Share

Issue Price: Rs. 27 Per Equity Share

Market Lot: 4000 Shares

Minimum Order Quantity: 4000 Shares

Listing At: BSE SME

Monday, February 27, 2017

RMC Switchgears SME IPO (RMC Switchgears IPO) Details

Akash Infraprojects SME IPO Details

IPO opens on: Feb 28, 2017

IPO closes on: Mar 6, 2017

Issue Type: Fixed Price Issue IPO

Issue Size: 2,040,000 Equity Shares

Face Value: Rs 10 Per Equity Share

Issue Price: Rs. 125 Per Equity Share

Market Lot: 1000 Shares

Minimum Order Quantity: 1000 Shares

Listing At: NSE SME

Saturday, February 25, 2017

5 Upcoming IPOs to hit the streets soon

Radio City FM's Music Broadcast IPO to open from March 6, 2017

It had filed IPO papers with the Securities and Exchange Board of India (Sebi) in November last year and received 'observation' from it on February 9, which is necessary for a company to launch the public offer

Music Broadcast IPO – Schedule (Tentative)

03rd March 2017 – Anchor Investors

06th March 2017 – Offer Opens

08th March 2017 – Offer Closes

14th March 2017 - Finalisation of Basis of Allotment

15th March 2017 - Unblocking of ASBA

16th March 2017 - Credit to Demat Accounts

17th March 2017 – Listing on NSE & BSE

Music Broadcast IPO Details

Music Broadcast IPO Tentative Details

Issue Opens on: 06 March 2017

Issue Closes on: 08 March 2017

Issue Type: Book Built Issue IPO

Issue Size: 14,670,530 Equity Shares

Face Value: Rs 10 per Equity Share

Issue Price: Rs.324 – Rs.333 per Equity Share

Market Lot: 45 shares

Listing At: NSE, BSE

Equity Shares outstanding prior to the Issue = 45,042,767 Equity Shares

Fresh Issue of 12,012,012 Equity Shares @333/- aggregating up to Rs.4,000 million

Offer for Sale of 2,658,518 Equity Shares @333/- aggregating up to Rs.885.3 million

Total Issue of 14,670,530 Equity Shares @333/- aggregating up to Rs.4885.3 million Equity Shares outstanding after the Issue = 57,054,779 Equity Shares

Category-wise Break up:

Anchor – 4,401,159 Shares = 146.56Crs.

Net QIB – 2,934,106 Shares = 97.71Crs

NII – 2,200,580 Shares = 73.28Crs

RII – 5,134,685 Shares (1,14,104 Forms) = 170.99Crs. (Lot size = 45)

Total Issue – 14,670,530 Equity Shares = 488.53Crs.

Avenue Supermarts IPO to open from March 8

The IPO of Avenue Supermarts, which operates a retail chain under the D-Mart brand, is set to open on March 8, 2017

The issue is likely to be priced in the range Rs 290-299, said a banker to the issue.

The company plans to sell shares worth Rs 1,800 crore in the IPO. This would be the second IPO of the year. In January, BSE raised about Rs 1240 crore. The IPO was subscribed 51 times

D-Mart own chain of around 120 retail stores across 45 cities, most of them in Maharashtra and Karnataka.

As of March 31, 2016, Avenue Supermarts posted a revenue of about Rs 8,600 crore, and a net profit of about Rs 320 crore.

In the past four years, Avenue Supermarts grew revenue by 40% and net profit by 52% annually

Thursday, February 23, 2017

Music Broadcast IPO Dates Schedule

Music Broadcast IPO – Schedule (Tentative)

03rd March 2017 – Anchor Investors

06th March 2017 – Offer Opens

08th March 2017 – Offer Closes

14th March 2017 - Finalisation of Basis of Allotment

15th March 2017 - Unblocking of ASBA

16th March 2017 - Credit to Demat Accounts

17th March 2017 – Listing on NSE & BSE

Wednesday, February 22, 2017

How to apply to OFS - Back to Basics

Steps to apply to Offer for Sale (OFS) in India:

- You need to have a demat and trading account to apply to an OFS

- Once the OFS starts, you can participate in the process yourself using your online trading accounts such as ICICI Direct, Kotak Securities etc. by placing your bids under the IPO / OFS section of their respective broking websites

- You will be given application form number / confirmation reference for your application

Tuesday, February 21, 2017

Nitiraj Engineers IPO (SME IPO) - Objects to the issue

The objects of the issue for Nitiraj Engineers IPO (SME IPO) are:

1. Development of new products;

2. Setting up manufacturing Unit for the existing and new range of products;

3. Expansion of Marketing Network and Brand building;

4. General Corporate Purposes;

5. Issue Expenses.

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

Nitiraj Engineers IPO (Nitiraj Engineers SME IPO) Details

IPO Open between: Feb 20, 2017 - Mar 1, 2017

Issue Type: Fixed Price Issue IPO

Issue Size: 2,200,800 Equity Shares of Rs.10

IPO Price: Rs. 100 Per Equity Share

Market Lot: 1200 Shares

Minimum Order Quantity: 1200 Shares

Listing At: NSE SME

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

Global Education IPO (SME IPO) Final Subscription Status

Global Education SME IPO Final Subscription as on 21-Feb-2017 - 7.00 P.M.

Retail - 115.63 times

HNI - 52.11 times

Overall - 82.25 times

Update: Global Education SME IPO Allotment Status declared. Check out link below

http://www.indianipoblog.in/2017/02/global-education-sme-ipo-allotment.html

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

BEL OFS - Retail Investor Discount

Bharat Electronics Ltd - BEL Offer for Sale (OFS)

Monday, February 20, 2017

TCS Buyback - Tata Consultancy Services to buyback shares

Sunday, February 19, 2017

Avenue Supermarts IPO - List of Company promoters

The Promoters of the Company are:

1. Radhakishan S. Damani;

2. Gopikishan S. Damani;

3. Shrikantadevi R. Damani;

4. Kirandevi G. Damani;

5. Bright Star;

6. Royal Palm Trust;

7. Bottle Palm Trust;

8. Mountain Glory Trust;

9. Gulmohar Trust; and

10. Karnikar Trust

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

Avenue Supermarts (D-Mart) IPO - Objects to the Issue

The net proceeds of the IPO are proposed to be used as set forth below:

1. Repayment or prepayment of a portion of loans and redemption or earlier redemption of NCDs availed by the Company;

2. Construction and purchase of fit outs for new stores;

3. General corporate purposes.

IRB InvIT Fund IPO gets SEBI clearance

IRB InvIT Fund, an investment trust sponsored by IRB Infrastructure Developers, has received markets regulator SEBI's approval to raise Rs. 4,300 crore through initial public offering (IPO)

IRB InvIT's IPO comprises fresh issue of units worth up to Rs 4,300 crore by the trust and an offer for sale of units by IRB Infrastructure Developers and its subsidiaries -- Modern Road Makers, Aryan Toll Road, ATR Infrastructure and Ideal Road Builders

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

Upcoming IPOs in March 2017

1) D-Mart / Avenue Supermart Ltd IPO

The issue price band is expected to be in between Rs 290 to Rs 300 per share.

Expected date of the issue is 8-Mar-17 and closure date is 10-Mar-17

Grey market price is between Rs 175 to Rs 178.

2) CDSL Limited IPO

The issue price band is expected to be in between Rs 115 and Rs 135.

Expected date of the issue is 15-Mar-17 and closure date is 17-Mar-17

3) Continental Ware housing Corporation Limited IPO

The issue size is expected to be Rs.418 Crores.

Expected date of the issue is 22-Mar-2017 and closure date is 24-Mar-2017

4) NSE Limited IPO

The issue size is Rs 10,000 Crores.

The issue price band is yet to be known as it is in the process of getting final clearances from SEBI.

Expected date of the issue is in Mar-2017 / Apr-2017

5) Music Broadcast Limited IPO

The issue size is expected to be around Rs 400 Crores

Expected date of the issue is in mid of Mar-2017

Click link below for more updates and details of each of Upcoming IPOs in March 2017

http://www.indianipoblog.in/2017/02/upcoming-ipos-in-march-2017.html?m=1

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

Saturday, February 11, 2017

Eris Lifesciences files DRHP for IPO

The IPO comprises an offer for sale (OFS) by the drug company’s private equity backer ChrysCapital and some of the founding shareholders.

Eris Lifesciences is the first pharmaceutical company to file its draft papers this year. The last pharmaceutical firm to go public was Warburg Pincus-backed Laurus Labs in November 2016. Before that, Alkem Laboratories went public in January 2016.

Friday, February 10, 2017

NSE IPO Immediate Priority: NSE CEO

Thursday, February 9, 2017

Avenue Supermarts (D-Mart) IPO - Company overview

Can you apply to IPO for family from your bank account? - IPO FAQ

Wednesday, February 8, 2017

Tuesday, February 7, 2017

Avenue Supermarts IPO Opening Date - Price Band

Avenue SuperMarts IPO Details

Issue Opens on: Mar 8, 2017

Issue Closes on: Mar 10, 2017

Issue Type: Book Built Issue IPO

Issue Size: 62,393,631 Equity Shares

Face Value: Rs 10 Per Equity Share

Price Band: Rs.290 to Rs.299 per equity share

Market Lot: 50 shares and in multiples thereof

Listing At: NSE, BSE

Avenue Supermarts IPO Category-wise Break up:

Anchor – 1,87,18,089 Shares

Net QIB – 1,24,78,726 Shares

NII – 93,59,045 Shares

RII – 2,18,37,771 Shares

Size = 1865.57Crs.

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for early bird members - First come first serve basis)

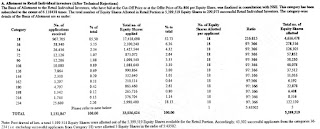

BSE IPO - Basis of Allotment - Retail Investors

A. Allotment to Retail Individual investors (After Technical Rejections)Tha Basis of Allotment to the Retail Individual Investors, who have bid at the Cut-Off Price or at the Offer Price of Rs 806 per Equity Share, was finalized in consultation with NSE. This category has been subscribed to the extent of 6.118438 times. The total number of Equity Shares Allotted in Retail Portion is 5,399,519 Equity Shares to 299,973 successful Retail Individual Investors. The category-wise details of the Basis of Alotment are as under:

| Category | No. of applications received | % of total | Total no. of Equity Shares applied | % to tolal | No. of Equity 5hares Allotted per applicant | Ratio | Total no. of Equity Shares allotted |

| 18 | 967,705 | 85.50 | 17,418,690 | 52.73 | 18 | 216:815 | 4,616,478 |

| 36 | 58,340 | 5.15 | 2,100,240 | 6.36 | 18 | 97: 366 | 278,316 |

| 54 | 26,436 | 2.34 | 1,427,544 | 4.32 | 18 | 97: 366 | 126,105 |

| 72 | 12,126 | 1.07 | 873,072 | 2.64 | 18 | 97: 366 | 57,852 |

| 90 | 12,206 | 1.08 | 1,098,540 | 3.33 | 18 | 97: 366 | 58,230 |

| 108 | 10,080 | 0.89 | 1,088,640 | 3.30 | 18 | 97: 366 | 48,078 |

| 126 | 7,864 | 0.69 | 990,864 | 3.00 | 18 | 97: 366 | 37,512 |

| 144 | 2,310 | 0.20 | 332,640 | 1.01 | 18 | 97: 366 | 11,016 |

| 162 | 1,297 | 0.11 | 210,114 | 0.64 | 18 | 97:366 | 6,192 |

| 180 | 4,797 | 0.42 | 863,460 | 2.61 | 18 | 97: 366 | 22,878 |

| 198 | 1,342 | 0.12 | 265,716 | 0.80 | 18 | 97: 366 | 6,408 |

| 216 | 1,744 | 0.15 | 376,704 | 1.14 | 18 | 97: 366 | 8,316 |

| 234 | 25,600 | 2.26 | 5,990,400 | 18.13 | 18 | 97: 366 | 122,130 |

| Please refer to note below | 1 | 5:43502 | 5 | ||||

| TOTAL | 1,131,847 | 100.00 | 33,036,624 | 100.00 | 5,399,519 | ||

Note: Post drawal of lots, a total 5,399,514 Equity Shares were allotted out of the 5,399,519 Equity Shares available for the Retail Portion. Accordingly, 43,502 successful applicants from the categories 36-234 ( i.e. excluding successful applicants from Category 18) were allotted 5 Equity Shares in the radio of 5:43502.

Monday, February 6, 2017

Avenue Supermarts (D-Mart) IPO opening date

Sunday, February 5, 2017

How to apply in IPO through ASBA? - IPO FAQ - Back to Basics

What is ASBA? Application Supported by Blocked Amount - Back to Basics

containing an authorization to block the application money in the bank account, for subscribing to an issue.

Saturday, February 4, 2017

Steel City Securities IPO - Objects to the Issue

Steel City Securities IPO opens from Feb 6

NSE appoints new Managing Director and CEO

Friday, February 3, 2017

BSE listing price: BSE lists at stunning premium

BSE has created history with its listing with the stock opening at Rs.1085 at a staggering premium of over 35 percent

At 10.09 AM, the stock was trading at Rs. 1138 after touching an intraday high of as high as Rs.1200

Stay tuned for more on BSE IPO!

Thursday, February 2, 2017

BSE to list tomorrow on NSE

The equity shares of Bombay Stock Exchange (BSE) is all set to be listed on National Stock Exchange (NSE) with effect from Feb 3, 2017

For real time news and updates on the latest developments in Indian IPO markets, join Indian IPO Blog group on Whatsapp!

Send in name and city of residence to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now!

(Free for early bird members)

BSE Listing Announcement - NSE

NATIONAL STOCK EXCHANGE OF INDIA LIMITED

DEPARTMENT : LISTING DEPARTMENT

Download Ref. No.: NSE/CML/34095 Date : February 01, 2017

Circular Ref. No.: 88/2017

To All Members

Sub : Listing of Security (IPO)

Members of the Exchange are hereby informed about the forthcoming listing of security (ies) on the

Exchange as follows:

Name of the company: BSE Limited

Symbol: BSE

ISIN: INE118H01025

The date of listing of the security (ies) shall be informed through a separate circular.

For and on behalf of

National Stock Exchange of India Limited

Divya Poojari

Manager

Wednesday, February 1, 2017

List of Upcoming IPOs - 2017

IPO Company List - 2017

CL Educate Limited

Prataap Snacks

BSE India

NSE India

GVR Infra Projects Limited

Paranjape Schemes Limited

SSIPL Retail Limited

Matrimony.com

Sandhar Technologies Ltd

Maini Precision Products Ltd

KPR Agrochem Limited

New Delhi Center for Sight Limited

Nihilent Techonologies Limited

Hinduja Leyland Finance Ltd

Seaways Shipping and Logistics Limited

Continental Warehousing

Mas Financial Services

D-Mart Supermarket

SIS Limited

Vodafone India

SBI Life Insurance

Go Airlines

Aster DM Healthcare

IRB InvIT Fund

Security & Intelligence Services

Genesis Colors

Shankara Building Products

Avenue Supermarts

G R Infraprojects

Cent Bank Home Finance Limited (CBHFL)

VLCC Health Care

BSE IPO Basis and Ratio of Allotment

Following is the basis of allotment of BSE IPO for Retail category:

BSE Ltd Basic of Allocation

Alloted 18 shares to applicant category As Follows :-

Sh Ratio

18 216:815

36 97:366

54 97:366

72 97:366

90 97:366

108 97:366

126 97:366

234 97:366

BSE IPO Allotment Status declared

BSE IPO Allotment Basis

BSE IPO Basis of allotment to retail investors is likely to be in the ratio of 1:4. The ratio would roughly translate to around 25 percent of applicants getting 18 equity shares

BSE IPO Allotment Status is declared and can be checked from link given below:

Click here to check now

Get real time updates and stay up to date with the latest developments in Indian IPO markets! Send in your request to join the group with your name and city to +91 79776 14821 OR Click here to join the Indian IPO Blog Whatsapp group now! (Free for first 500 members - First come first serve basis)